Alternative Investments In a Portfolio Context

“The definition of genius is taking the complex and making it simple”. The wealth management industry offers an overabundance of financial services and products, with many of those solutions being unnecessarily complex or subject to layers of hidden fees. Alternative Investments, which can be both more complex and have higher fees relative to more traditional investments, have rapidly grown in popularity and accessibility over the past decade. As they now enter the mainstream, already accounting for over 10% of total invested assets, it is worth questioning their true value and devising strategies for optimizing their use.

Chesapeake has a rich heritage in alternative investments due to the firm’s 25-year involvement advising families, endowments, and foundations on the entire range of alternative assets (including hedge funds, growth equity, venture capital, private credit, real estate). We see alternative investments as an essential tool to constructing long-term, all-weather, multi-asset portfolios, but feel most investors lack a clear understanding of how to use alternatives in a portfolio context. CAM has developed a simple asset allocation framework for incorporating alternative investments that is both targeted and value additive.

A New Framework

The cornerstone of traditional investing is a portfolio of equities and bonds. Over the years, these two asset classes have become increasingly accessible, liquid, and cost efficient. The 60/40 portfolio, which allocates 60% to US equities, and 40% to bonds, has delivered high-single-digit annualized returns over the past 50 years—a $10,000 initial investment would be worth over $500,000 today!

Alternative investments are financial assets that fall outside of the conventional asset class categories. They include private equity, venture capital, many hedge fund strategies, private lending, property & infrastructure assets, art, commodities, and other types of investments. Alternative investments are typically complex, carry relatively high fees, and have liquidity restrictions, in some cases requiring a time horizon of ten years or more. Should they then be part of an investment portfolio, and if yes, what is the role they are meant to play?

Some benefits of alternative investments are obvious. They offer access to talent—the high fees also mean that financial rewards are much higher for managing an alternatives investment vehicle than a traditional one, so many highly competent managers gravitate here. The lack of immediate liquidity can also become a positive when it enforces a long-term approach and minimizes the risk of being reactionary and selling out of investments at the worst time. The returns of the 60/40 are great over the long-term but most people end up realizing a significantly lower return because of sentiment-based entry and exit decisions. The larger question is not whether to use alternatives but how to use them, and how to narrow down a universe that includes so many different strategies and a myriad of potential managers implementing each strategy.

In the past, CAM has used alternatives for a variety of reasons, as a proxy of the equity market with (theoretically) better downside protection, as an alternative to bonds, or simply to diversify into new strategies or access an exceptional portfolio manager. However, our thinking on the matter has evolved and we now believe alternatives should serve one of two purposes: i) enhance portfolio return, or ii) enhance portfolio stability by providing true diversification without diluting the overall return.

Return Enhancers

If the 60/40 can deliver high-single digit returns over time, it will take a return well into the double-digits to provide a material uplift to the overall return. There are only two credible ways to achieve such above-market returns:

- Invest in secular growth assets that are capturing a market or industry trend that offers returns substantially higher than the economy’s growth potential. Technological and other innovations clearly play an important role here, and the relevant alternative strategies include growth equity investments, venture capital, and other equity-type investments in high-growth companies or sectors.

- Invest in assets that trade at very deep discounts to their intrinsic value following a significant market dislocation. The return potential in this case comes less from the type of asset and more from the timing of entry and price at which the asset is bought. This requires a highly opportunistic approach that actively looks for areas where significant market damage has preceded. Relevant alternative strategies include distressed or deep-value investing, some activist or buyout strategies, and focused, opportunistic investments to specific regions or industries that are going through extreme distress.

The priority with Return Enhancers should be to maximize upside potential rather than protect downside or reduce volatility. The allocator should accept that the probability that one or more of the underlying investments goes to zero is non-trivial and build a diversified portfolio of modestly sized positions in high-return assets rather than a more concentrated portfolio.

Stability Enhancers

A portfolio of just equities and bonds is highly sensitive to the gyrations of the economic cycle. Negative economic growth has an adverse effect on earnings and can cause bear markets in equities (although the timing is not always clear-cut, with equities declining in anticipation of negative growth and recovering while the economy is still near the bottom). Corporate bonds can also decline dramatically in a recession due to rising perceived credit risk, while government bonds, often a source of safety, are still subject to losses if there is stagflation or doubts about the government’s finances. In a portfolio context, there is clearly value in adding an asset that can generate an independent return stream that is uncorrelated to traditional asset classes, especially if it can be done without diluting the long-term return potential of the overall portfolio.

Most alternative managers tout their strategies as uncorrelated, but many times the underlying correlation to risky assets becomes painfully clear in adverse market conditions. We believe truly uncorrelated strategies do not try to optimize the selection and purchase timing of certain assets, but instead capture unique market inefficiencies or invest in a predictable or mean-reverting spread between different assets.

Successful, diversifying strategies CAM has invested in over the past few years include:

- A strategy that profits from pre-positioning to take advantage of predictable equity flows that happen around an index rebalancing event, when all the passive funds/ETFs need to sell certain stocks and buy others to reflect the announced changes in composition of the indices they are aiming to track.

- A specialty lending strategy that, for a variety of reasons, is often the sole lending provider in a transaction, and hence able to structure loans with strong downside protections and a highly asymmetric payoff.

- A strategy that exploits price dislocations between two financial instruments of the same underlying asset e.g., differences between spot and futures market prices, or dislocations between the equity, credit and derivatives prices involving the same corporate issuer.

- Investments in closed end funds that trade at a significant discount to the value of their underlying holdings.

- A strategy that relies on the trading ability of the manager who has a wide mandate to invest in all asset classes, long or short, and operates under tight risk limits.

It is important that Stability Enhancers do not dilute overall returns. For example, cash or near-cash instruments add stability but can be highly dilutive to overall return. The return threshold should be at least mid-to-high single digits, or in line with the long term return of the 60/40 but with a significantly higher Sharpe ratio and much better hit ratio (calculated as the percent of positive return months).

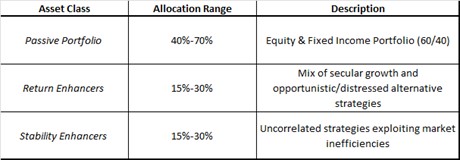

Alternative strategies that do not fit the above criteria should not feature in the portfolio. The result is a significantly narrower investable universe since many strategies rely on a manager’s ability to select equity or fixed income securities and/or have return profiles that either fail to meet the required hurdle rate or have a strong positive correlation to the broader market. A simple asset allocation framework can look as follows:

The framework offers several degrees of flexibility. For example, even within the wide 40%-70% range for the Passive Portfolio, there is room to tweak the relative equity/bond allocations or the split of the fixed income allocation between cash, sovereign, and riskier corporate bonds. The Return Enhancers category can shift its weighting from the secular growth to the distressed category, depending on the number of distressed opportunities available. Finally, in both Return and Stability Enhancers, the underlying investments/managers are not fixed; there should be a continuous effort to upgrade the underlying mix as new, more attractive opportunities emerge and underperforming managers are removed.

The Paradox of Choice

The paradox of choice suggests that, while an abundance of options theoretically improves the possibility of finding the one that is right for us, the increased effort required to sift through the options can become counterproductive and lead to suboptimal outcomes. Alternative investments have expanded the investable universe, offering an opportunity to build more diversified portfolios that can navigate all types of market environments—this is generally a good thing. Both private and institutional investors should take full advantage of the enhanced opportunity set, but do so intelligently, with a targeted approach that clearly defines what role those investments should play within the broader portfolio.

Gerasimos J. Efthimiatos is CEO and Managing Partner of Chesapeake Asset Management, a privately owned investment advisor founded in 1998, serving as a long term strategic partner to families, endowments, and foundations.